“Perspectives” is a new blog featuring different points of view of the same topic and how it relates to US/Japan business matters. This time, we discuss the automotive industry in the USA as seen from 1) consulting, 2) sales & marketing, 3) HR viewpoints and 4) management. Please join in the discussion, and let us know if you have feedback on this new structure. 【日本語はこちらをご覧ください。】

#1: Consulting

Case Studies by A-Lex: Japanese Companies in the US Automotive Market

The US automotive production volume in 2019 was 17.05 million units while it was 9.21 million in Japan. Investments toward the next-generation technologies such as CASE are very active in the US, and the US market’s door is wide open for new and innovative technologies and products no matter how small or new companies they are from – only if proper marketing is practiced to enter the market. We’d like to share a couple of successful implementations A-Lex made with Japanese companies.

Case 1: Emblems for Toyota

There was a claim that a piece of plated ABS emblem hit the face of a driver when the airbag was exploded. A-Lex saw a demand for safer emblems and started to work with Japanese plastic and nameplate manufacturers to invent aluminum-metalized elastomer emblems that retained flexibility and did not get damaged on the surface when bent. A-Lex presented this new method with a large amount of test data that proved the new emblems’ bending strength and heat resistance. Now the emblem has been adopted to all Toyota vehicles manufactured in the US.

Case 2: Stainless Steel Parts for Exhaust Systems

Although some defects such as blowholes or shrinkage cavities in stainless casting are inevitable, they could cause serious accidents. Automotive industry had approx. 0.05 return rate of these stainless products after delivery, and A-Lex found this rate too high and introduced a Japanese manufacturer. This manufacturer had extremely thorough inspection systems for the entire 13 production processes and technically no returns. A-Lex emphasized the company’s thoroughness and successfully replaced existing competitors with the company.

Case 3: Precision Metal Component Prototyping

It usually takes more than a month to complete prototyping of automotive components. This Japanese prototyping company, on the other hand, offered high-precision prototype parts within one week. A-Lex differentiated them from competitors by emphasizing their accuracy and promptness, in addition to their cutting skills of difficult-to-process materials such as SUS 630, 64 Titan, Inconel and flexibility to accept small orders from 1 unit and successfully won orders.

*****************************************

A-Lex International Marketing, LLC is a business consulting firm that helps Japanese companies expand into the US market. Since 2007, we have been supporting our clients’ new businesses and management in North America. A-Lex also helps a number of US companies who adopt Japanese technologies and craftsmanship (=Takumi) to their operations.

We are proud of our track record of bringing high-potential products and services to both Japan and US markets. For more information, please visit our website at https://www.a-lexint.com.

#2: Sales & Marketing

Automotive Suppliers Must Navigate A Constantly Shifting Landscape

The automotive supplier industry is a resilient industry. Over the past twenty years the industry has faced many challenges and although there are a few examples of companies that failed, the industry overall has flourished. The general euphoria of the past ten years however has come to a screeching halt. Due mainly to the COVID pandemic but also caused by stagnation in key global markets and the United States, the industry faces significant headwinds over the next three to five years.

Short to midterm challenges facing the industry include;

- Erratic demand caused by the industry shutdown and “rolling” start-up

- Liquidity issues will require suppliers to seek funding from sources other than traditional banks.

- Capital expenditures and R & D budgets reduced

- Capacity utilization and risk mitigation require relevant strategies

- Programs either delayed or cancelled

Longer term changes facing the supply base include;

- Increase in M&A / consolidation activity

- Focus on fewer systems while working towards technology and cost leadership

- Transition from ICE to Hybrid to BEV

- Conquest business strategies become more prevalent

- Increase in component localization

The headwinds are strong and unpredictable however the mega Tier 1s and the start-up / specialty players are probably best positioned to “weather the storm”. In the short term the midsize Tier 1s and 2s have the most exposure to liquidity/debt issues causing more uncertainty for these companies.

In conclusion, the automotive supplier industry is again navigating uncharted “waters”. Although there is significant uncertainty in the short and midterm, this industry has always prevailed and come out of these periods of change and turmoil stronger and better positioned for the future.

I look forward to receiving your questions and or feedback on this post. Thank you!

#3: Bilingual Human Resources

Supporting the Synergy of Japanese and American Employees

Cultural differences in business affect and sometimes frustrate American and Japanese people who work together on multicultural teams/projects. Understanding what these cultural differences are can make a world of difference in business relationships. Let’s dig into two of them.

High/Low Context Societies

Anthropologist Edward T. Hall explained the concept of high and low context societies and psychologist Geert Hofstede also clarified it in his cultural dimensions theory. “High” ones are collectivist, have less explicit communication, and focus on long-term and hierarchical relationships. “Low” ones focus on individualism, multiculturalism, direct expressions and equality. “High context” Japan places a greater importance on values such as relationship building, respectful communication and hierarchy, and “low context” US values transparency and competition. Decision-making is a great example of how this plays out: in the US, approval precedes the work, and in Japan, you receive approval once much of the work is completed. [By the way, examples can be seen in your everyday lives, too, regardless of which country you are from. “High” includes family gatherings, parties with friends, or a local restaurant with regular clientele. “Low” can include going to the airport or a large chain supermarket.]

Nemawashi

“Nemawashi” means “to plant a seed” in Japanese, and can be considered as a way to test the waters by giving necessary parties a head’s up. When making a decision, Japanese people can take their proposal to various employees, departments and managers to hear their feedback and get unofficial buy-in. This can sometimes frustrate Americans who do not understand why decisions can take so long to make, but once the proposal is tweaked and ready to submit, it can then be quickly approved because all parties are on the same page.

A Solution

HR departments or management can facilitate discussions between key Japanese and American personnel to have open and honest conversations so each side can understand the other. Many times, these frank discussions not only resolve the problem, but they strengthen the participants’ personal relationships and allow for a more cohesive team.

#4 Management

Japan’s Largest Companies are Staying in the Fortune Global 500

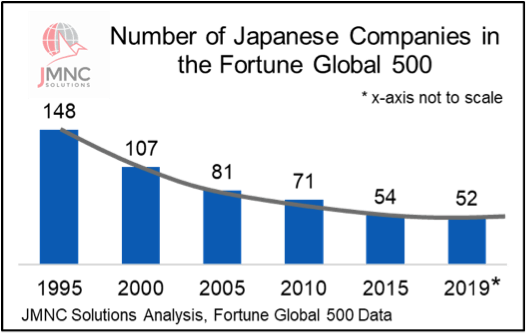

Since 1995, ninety-six Japanese companies have dropped out of the Fortune Global 500. What’s important to note, however, is that the fastest rate of decline occurred from 1995 to 2005, after which the rate of decline slowed and now is almost flat. Over the past 5 years (since 2014) the United States dropped more companies from the list than Japan.

Growing in the Automotive Industry

Divesting under-performing or non-strategic areas and acquiring companies accretive to the bottom line or with a larger global footprint can be a very smart move.

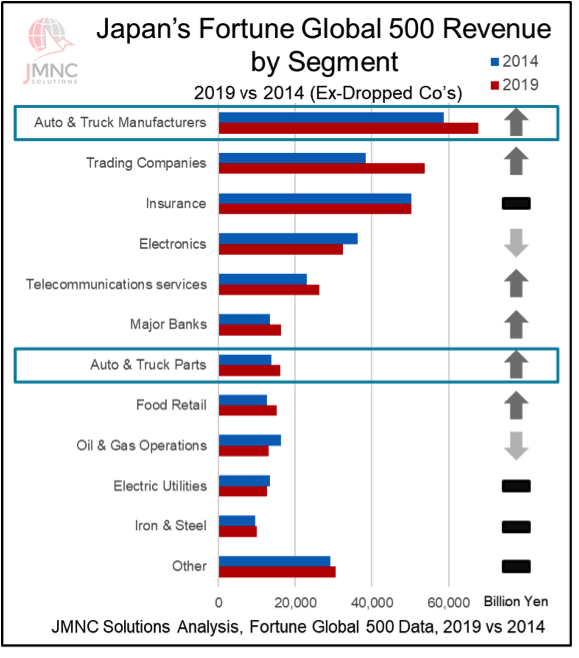

Take Hitachi for example. Revenue was down slightly in 5 years, and profit was up. They’ve executed some smart divestitures along the way, which contributed to lowered revenue and higher profit, while positioning them for strategic acquisitions in the automotive industry (Honda affiliates Keihin Corp., Showa Corp. and Nissin Kogyo Co). Japan’s largest companies perform relatively well in this industry. This chart shows how Japan’s largest company revenues have grown in the two key automotive segments: Auto & Truck Manufacturing and Auto & Truck Parts.

For more insights on Japanese global business trends, please go to Chet’s Blog: Are Japan’s Largest Companies Shrinking.

JMNC Solutions is a niche management consulting company focused on challenges faced by Japanese companies in times of rapid change. We’re helping leaders respond to the COVID-19 crisis in ways that are fit for the times, and for the markets you compete in. Visit our website for more information.

Please join in the discussion; we would love to hear your thoughts on this topic!

Photo by John Arano on unsplash.com.